The international delegation, headed by Ana Lucía Bueno, ICRC Public Health Coordinator, and Sujit Panda, Head of the Physical Rehabilitation…

This final instalment showcases the crown jewels of Ukraine's defence innovation — the battle-proven, high-return technologies that are not just changing the face of modern warfare but are also creating unparalleled investment opportunities. This is a look inside the forging of the Arsenal of the Free World.

In the first parts of our series, we analysed the innovative financial architecture of the ‘Danish Model’ and the powerful coalition of investors it has assembled. Having established how capital is being mobilised, we now turn to the most critical question: what is this capital funding?

The Ukrainian defence-industrial complex (DIC), hardened in the crucible of high-intensity war, now represents a unique, high-yield investment opportunity unmatched on the global market. This is no longer a nascent industry; it is a rapidly maturing ecosystem driven by aggressive state stimulus and a battlefield-tested innovation cycle that drastically de-risks R&D.

The market scale is formidable. In 2024, Ukraine’s arms production tripled to $9 billion, with the government setting an ambitious target of $35 billion in production capacity for 2025. This growth is underpinned by robust state demand, with approximately $18.5 billion of the national budget allocated directly for arms and military equipment procurement in 2025. The success of the ‘Danish Model’ has validated the financial mechanics of supporting this ecosystem, but the true value lies in the products themselves. For international partners, investing in Ukraine is about acquiring access to a portfolio of cost-effective, combat-tested, and category-defining defence technologies.

This analysis highlights the most promising investment verticals, demonstrating why Ukraine’s DIC is the cornerstone of the “affordable arsenal of democracy”.

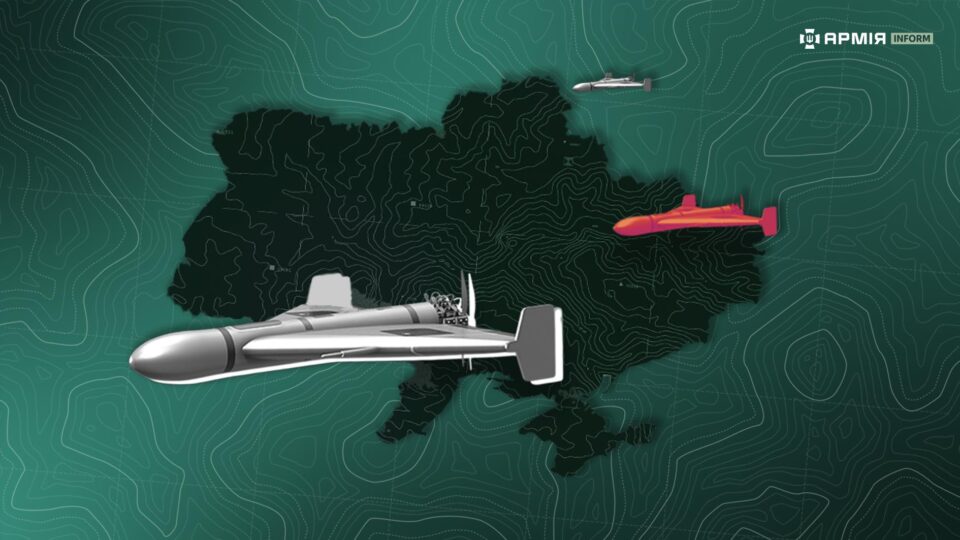

Ukrainian long-range UAVs have evolved from tactical assets into strategic deep-strike weapons, holding high-value targets hundreds of kilometres within enemy territory at risk. This capability creates a new paradigm of asymmetric warfare, achieving effects previously reserved for multi-million-pound cruise missiles at a fraction of the cost.

The Investment Case: The core appeal is achieving strategic effects with expendable, low-cost assets. This creates a huge potential export market for nations seeking affordable strategic deterrence without the political and financial burden of traditional missile systems.

Ukrainian Unmanned Surface Vessels (USVs) have rendered traditional naval doctrine in the Black Sea obsolete, creating an entirely new category of maritime warfare assets.

The Investment Case: Investing in the MAGURA V7 is not backing an incremental improvement, but a new category creator in coastal access-denial (A2/AD) systems. The Stalker 5.0’s dual-use capability and low cost open up a vast market for nations seeking affordable maritime assets.

Driven by the principle “robots should fight, not people,” Ukraine is experiencing explosive growth in Unmanned Ground Vehicles (UGVs). With over 200 companies in the sector and a government plan to field 15,000 robotic systems in 2025, the state-backed demand is clear and compelling. These UGVs are already indispensable battlefield tools:

The Investment Case: This is a rapidly growing market with powerful government support and a clear strategic goal: automating 100% of frontline logistics to save human lives. An investment in scalable, multi-functional UGV platforms is an investment in the very future of land warfare.

The most valuable innovations in Ukraine are often not the drones themselves, but the systems that allow them to operate in a fiercely contested electromagnetic environment.

The Investment Case: A reliable, scalable, and affordable jam-proof Command and Control (C2) system is the holy grail of modern warfare. The company that perfects this technology will own a key enabler that could be licensed to virtually every drone manufacturer in the world, representing a far larger and more defensible market than any single drone platform.

Ukraine’s approach to armoured vehicles has shifted from passive protection to active, networked defence, reflecting a deep understanding that the primary threat now comes from the air.

The Investment Case: Investors should view this not as a vehicle manufacturer, but as an integrated combat systems company — a far more valuable proposition that provides solutions to the most pressing threats facing modern mechanised forces.

The 2S22 “Bohdana” self-propelled howitzer exemplifies Ukraine’s ability to rapidly scale production of NATO-compatible systems while maintaining a decisive cost advantage.

The Investment Case: In a war of attrition, quantity has a quality all its own. A battle-proven system that delivers 80% of the performance at 40% of the price is a winning formula for the global export market, positioning Ukraine to dominate the “value” segment of the global artillery market.

The emergence of the FP-5 “Flamingo” cruise missile, developed by Fire Point, signals Ukraine’s entry into the elite club of nations capable of producing strategic-level strike weapons. Now in serial production, its capabilities place it among the world’s best.

The Investment Case: The “Flamingo” is a strategic asset capable of altering the military balance by holding an adversary’s critical infrastructure at risk from extreme distances. This creates significant export potential for countries seeking a powerful deterrent without the political commitments tied to procuring weapons from major global powers.

The technologies emerging from Ukraine are not just weapons; they are solutions. They are the products of a unique, real-time innovation loop that connects the frontline with the factory floor.

For the international investment community and allied governments, the path forward is clear. The ZBROYA initiative, powered by financial mechanisms like the Danish Model, offers a de-risked, data-driven pathway to a deep and lasting industrial alliance. Investing in Ukraine’s defence sector is the most direct, economically efficient, and fastest path to securing Ukraine’s victory, rebuilding European defence industrial capacity, and architecting a stronger, more resilient security framework for the future. The time to build in and with Ukraine is now.

Author: Taras Tymchuk, Oleg Mashchenko

@armyinformcomua

As a result of an enemy mine explosion, the soldier suffered a partial amputation of his lower limb. The wounded man could not move on his own, so the “Bizon” g

During the day, units of the Unmanned Systems Forces grouping struck or destroyed 1,281 enemy targets.

On the night of March 5 the enemy attacked with 155 strike UAVs of the Shahed, Gerbera, Italmas types and other types of drones, about 100 of them being Shaheds

Over the past day, the army of the aggressor country lost 900 personnel, four tanks and 41 artillery systems.

During December, January and February, fighters of the Unmanned Systems Forces struck 54 enemy SAM systems and radars.

Volodymyr Zelenskyy held a meeting on the challenges for Ukraine and partners, as well as on our ability to help protect lives and stabilize the global market.

The international delegation, headed by Ana Lucía Bueno, ICRC Public Health Coordinator, and Sujit Panda, Head of the Physical Rehabilitation…